POMPANO BEACH, FL – Dot Hip Hop, LLC – the registry operator for the .hiphop top-level domain – has announced plans to raise capital through an equity crowdfunding campaign on Wefunder. The initiative, currently in the “Testing the Waters” phase allowed under U.S. securities law, is designed to measure investor interest before the company formally files its required Form C disclosure and begins accepting funds.

.hiphop was first delegated in 2014 as part of ICANN’s new gTLD program and was later acquired by Dot Hip Hop, LLC in 2021. So this is not a brand-new extension, but rather an existing one being repositioned.

The Offering

According to the campaign page, Dot Hip Hop is offering membership units in the company, with a minimum potential investment of $250 once the offering officially opens. The company has positioned the raise as an opportunity for members of the global Hip Hop community – artists, producers, entrepreneurs, and fans – to “own a piece” of the registry that represents their cultural identity online. DJ Madout has been named as lead investor for the effort.

At this stage, no money is being collected. Any expressions of interest on Wefunder are non-binding until the securities filing is complete and the offering formally launches.

Who is DJ Madout?

From public profiles, music platforms, and social media, DJ Madout appears to be:

- A DJ and event curator based in New York (Bronx / NYC area).

- Someone with musical training: he is said to have been professionally trained on saxophone and trombone, and developed an ear for various styles early.

- Influenced by a mix of genres – reggae, alternative rock (ex: Green Day), Caribbean music, also New York’s club / party culture.

- Known for hosting/promoting events in the NYC area (Bronx especially), such as parties and themed events: “Pajama Pillow Fight”, etc.

- Having performed / spun for various artists or in events with names such as Fred Da Godson, Shaggy, Sean Paul, Cardi B, etc.

- Active in logistic-roles beyond just performance: promotion, event management, community/community outreach (e.g. street events in the Bronx with back-to-school supplies) have been part of his activities.

- Also described as “Founder of Classic Man NYC” and CEO of PCR Media Group, Inc. in some profiles. X (formerly Twitter)

- The PRNewswire release announcing him as “Lead Investor” in the .HipHop campaign.

Current State of .HipHop

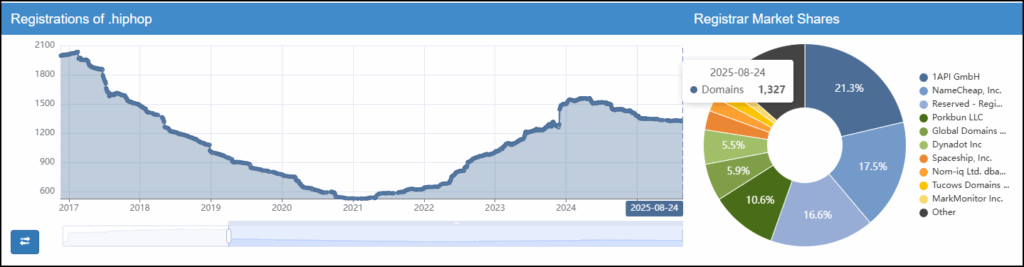

While the equity raise may draw new attention to the namespace, public registry statistics show that .hiphop remains a small extension compared to other new gTLDs.

- Registered Domains: According to NTLDStats, .hiphop currently has approximately 1,450 domains registered. Of those, about 40 are listed as upcoming deletes, meaning they are scheduled to be removed, leaving a stable base close to 1,400 active registrations.

- Share of nTLDs: Represents just 0.09% of all new gTLD registrations.

- Registrar Distribution: 1API GmbH (HEXONET / CentralNic) holds ~19.6% of registrations, followed by Namecheap at ~16.1%.

- Upcoming Deletes: Roughly 3–4% of current registrations are scheduled for deletion, suggesting some level of churn.

By comparison, larger new gTLDs such as .xyz and .online each maintain millions of domains under management, highlighting the uphill climb for more niche cultural TLDs like .hiphop.

What It Means

For potential investors, the numbers underscore both the risks and opportunities:

- Room to Grow: With such a small base, even modest adoption could represent significant percentage growth.

- Market Challenge: Without strong marketing and community buy-in, the extension risks remaining niche.

- Operational Costs: Running a gTLD involves ICANN compliance, technical back-end expenses, and registrar relationships, which can strain a registry with limited volume.

The equity crowdfunding push may help Dot Hip Hop fund outreach and increase awareness, but adoption by the actual Hip Hop community, not just domain investors, will be the key factor in whether the namespace expands or stays small.

Current Status & Pricing

The .hiphop extension is live and available to register today through major registrars, but usage is still modest. Here’s a table of current .HIPHOP domain pricing at a variety of registrars, based on publicly available data. Prices are for 1-year registrations unless otherwise noted. Taxes, fees, promotions vary.

| Registrar | 1-Year Registration Price (USD unless noted) | Renewal Price / Notes | Transfer Price / Notes |

|---|---|---|---|

| Dynadot | $21.62 Dynadot | $21.62 Dynadot | $21.62 Dynadot |

| Namecheap | $25.98 Namecheap | ~$33.98 Namecheap | (Not clearly listed) Namecheap |

| Gandi.net | $29.96 Gandi.net | $71.98 Gandi.net | ~$45.33 Gandi.net |

| Netim | $29.50 excl. VAT Netim | $29.50 excl. VAT Netim | ~$22.50 excl. VAT Netim |

| EuroDNS | ~€44.00 EuroDNS | Renewal ~€44.00 EuroDNS | Transfer ~€44.00 (comes with 1-year extension) EuroDNS |

| GoDaddy | $43.99 GoDaddy | (Likely similar or higher) GoDaddy | — GoDaddy |

The Bottom Line

As with any Regulation Crowdfunding effort, prospective investors will need to review the forthcoming Form C filing to understand valuation, unit terms, and risks. For now, the Wefunder page is less about raising money than it is about gauging interest – and about testing whether .hiphop can gain cultural traction beyond the domain industry. If Dot Hip Hop succeeds in rallying the broader Hip Hop community, the registry could establish a distinctive niche; if not, the extension may remain a small player in an already crowded new gTLD space.

Disclosure: “Testing the Waters”

- Definition: Under the Regulation Crowdfunding (Reg CF) rules, startups are allowed to gauge potential investor interest before formally filing their Form C with the SEC. This is called the “Testing the Waters” phase.

- Purpose: It allows companies to assess demand without incurring the full legal and compliance costs of a formal offering. If interest is low, they can walk away before spending heavily on filings and disclosures.

- Investor Impact:

- Any “reservation” or “expression of interest” during this stage is non-binding.

- No money changes hands – investors aren’t charged and the company can’t legally collect funds.

- Once the company files a Form C and the offering is officially qualified, investors are contacted again to confirm whether they still want to proceed.

- Legal Disclosures: The SEC requires clear disclaimers on all Testing the Waters communications. Companies must state that:

- No money is being solicited or will be accepted at this stage.

- Indications of interest do not constitute commitments.

- The actual offering will only occur after the filing of required documents.

About The Author: John Colascione is Chief Executive Officer of SEARCHEN NETWORKS®. He specializes in Website Monetization, is a Google AdWords Certified Professional, authored a how-to book called ”Mastering Your Website‘, and is a key player in several online businesses.

*** Here Is A List Of Some Of The Best Domain Name Resources Available ***

*** Here Is A List Of Some Of The Best Domain Name Resources Available ***

Leave a Reply